/01/12 · What is a forex lot? Forex is commonly traded in lots, which are essentially the number of currency units you can buy or sell. A “lot” is a unit of measurement for a transaction amount. When you place orders on your trading platform, they are placed in lots. The regular lot size is , units of currency, but there are now mini and micro lot sizes of 10, and /01/04 · These are the lot sizes that are available in Forex: Standard Lot: , currency units (lot size of 1 in MetaTrader) Mini Lot: 10, currency units (lot size of in MetaTrader) Micro Lot: 1, currency units (lot size of in MetaTrader) Nano Lot: 1 The lot size is a concept in forex trading used in measuring your position size and is defined as the number of currency units you are willing to buy or sell when you enter a trade. It is at the center of your risk management and affects most trading parameters, including the pip value of each currency pair, leverage, margin, money management, stop loss, and profit or blogger.comted Reading Time: 8 mins

What is a lot in Forex - Lots sizes Explained , , • TradeFX

Forex is commonly traded in lotswhich are essentially the number of currency units you can buy or sell. The regular lot size isunits of currency, but there are now mini and micro lot sizes of 10, and 1, units, respectively.

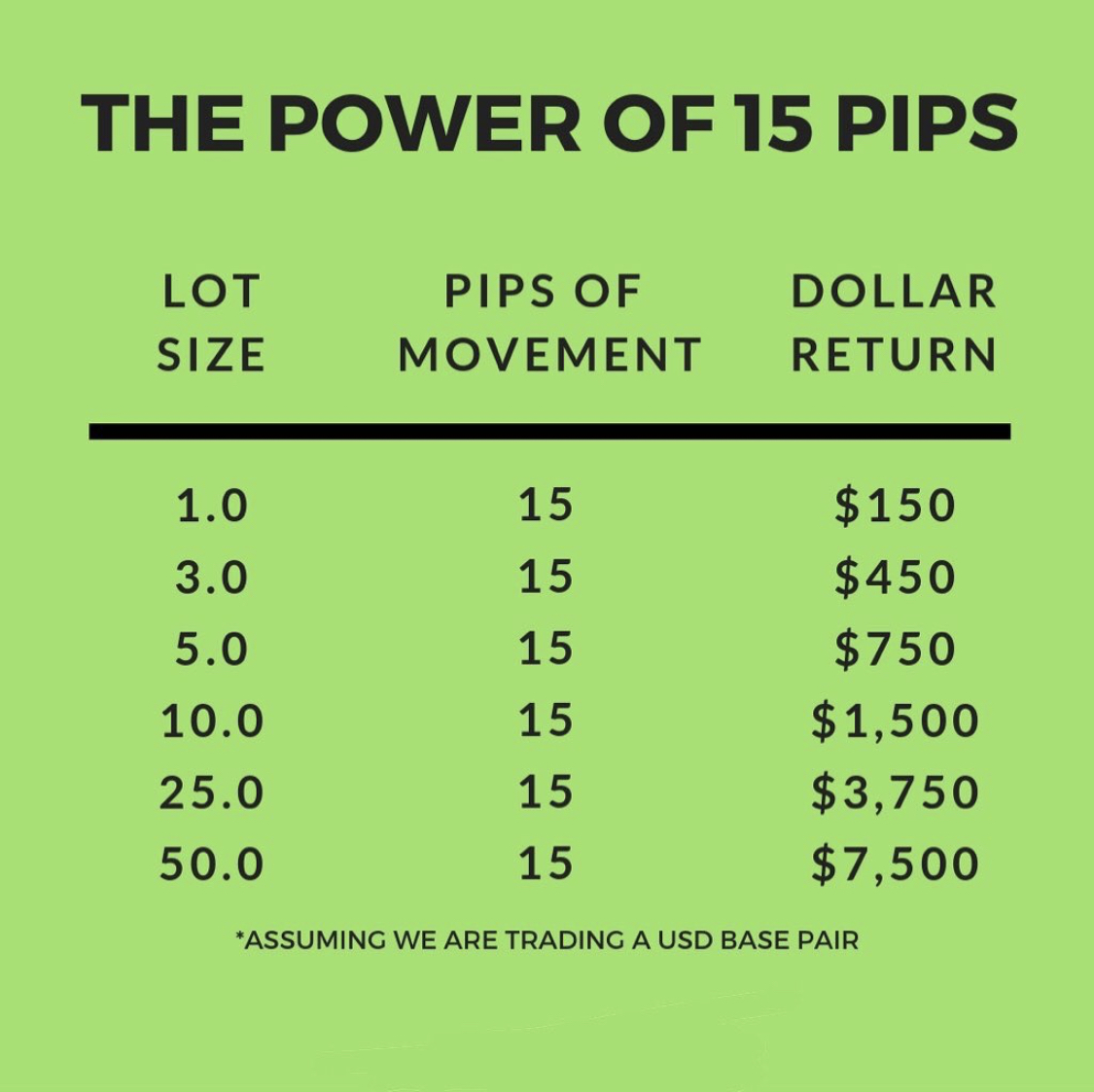

Picking the ideal lot size with a tool like risk management with the desired output will help you decide the best lot size based on your current trading account capital, forex lot size explained. The size of your trading lot directly affects how much forex lot size explained market change affects your accounts.

A pip move on a small trade, for example, would not be felt nearly as much as the same pip move on a larger trade, forex lot size explained. Your broker may use a different method for measuring pip values relative to lot size, but they will tell you what the pip value is for the currency you are trading at the time. A standard lot is one withunits. As a result, the majority of retail traders with limited accounts do not deal in standard lots.

It might not feel much, but keeping your lot size forex lot size explained a reasonable limit to your account size will help you protect your trading capital in the long run. A mini lot comprises of 10, units of your account currency. If you are a beginner and want to start trading with mini lots, make sure you have fair trading capital.

It is entirely up to you to determine your ultimate risk tolerance. Most brokers offer micro lots as the smallest tradeable Lot. A micro lot has 1, units of the currency used to finance your account.

If you finance your account in U. In the case of a dollar-based pair, forex lot size explained, 1 pip is equal to 10 cents. As mentioned earlier, a PIP is the smallest price change in currency trading. Pairs with JPY have a different approach. The aim of using PIP values per Lot is to decide how much money we gain or lose per PIP, taking into account the amount of currency that we want to trade with.

The first part of the calculation is a straightforward currency conversion; we divide our PIP value by the current exchange rate based on the pair we trade. This way, we will determine how much a PIP is worth in terms of the currency we are trading. The first part of the formula is doing a simple currency conversion; we divide our PIP value according to the pair we trade by the current exchange rate.

This way, we know how much that PIP worth in terms of the currency we are trading is. The second step is multiplying the result by the lot size we are trading with standard, micro, or mini to understand the effect of the previous number we calculated on the total number of currency units we are trading. We will now calculate some examples to see how it forex lot size explained the pip value.

Knowing the various Lot sizes available and how to measure the pip value will help you create effective risk management strategies while trading. Heinrich forex lot size explained a forex and CFD enthusiast with a passion for writing forex lot size explained informative quality content. He strives to showcase the best forex brokers in Africa. Join him on his Journey! With an…. Therefore, these…, forex lot size explained.

These prices update…. Username or Email Address. Remember Me. Read Review. Home Forex Trading Course What is a lot in Forex — Lots sizes Explained. What is a lot in Forex — Lots sizes Explained Categories: Forex Trading Course Author: Heinrich Le Roux. Date: 12 Jan AvaTrade is truly a global broker, regulated across 5 continents.

Local support. Sign up Sign up. Review Sign up Sign up CFD service. Your capital is at risk. Table of Contents. Categories: Forex Trading Course Author: Heinrich Le Roux. Heinrich Le Roux, forex lot size explained. Content Writer Market Analyst. What is Forex? What is Forex Trading? What is CFD Trading in South Africa? How Does Forex Trading Work? How to Trade Forex? How to Start Forex Trading?

How to Trade Forex for Beginners? What is Spread in Forex? What is Leverage in Forex? Leave a Reply Cancel reply You must login in order to comment a review. Login Username or Email Address Password Remember Me.

Visit Broker. Minimum Deposit. Welcome Bonus. Help me sign up. Let us help you get started!

What Is the Right Lot Size To Use in Forex Trading?

, time: 8:30

/01/12 · What is a forex lot? Forex is commonly traded in lots, which are essentially the number of currency units you can buy or sell. A “lot” is a unit of measurement for a transaction amount. When you place orders on your trading platform, they are placed in lots. The regular lot size is , units of currency, but there are now mini and micro lot sizes of 10, and /01/04 · These are the lot sizes that are available in Forex: Standard Lot: , currency units (lot size of 1 in MetaTrader) Mini Lot: 10, currency units (lot size of in MetaTrader) Micro Lot: 1, currency units (lot size of in MetaTrader) Nano Lot: 1 The lot size is a concept in forex trading used in measuring your position size and is defined as the number of currency units you are willing to buy or sell when you enter a trade. It is at the center of your risk management and affects most trading parameters, including the pip value of each currency pair, leverage, margin, money management, stop loss, and profit or blogger.comted Reading Time: 8 mins

No comments:

Post a Comment